Mileage Reimbursement 2024 Format

Mileage Reimbursement 2024 Format. Calculating mileage reimbursement involves a few key steps: Use the current irs standard mileage rate or a rate set by.

* airplane nautical miles (nms) should be converted into statute miles (sms) or. 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own.

Use The Current Irs Standard Mileage Rate Or A Rate Set By.

Alternatively, i can use my own car with irs mileage reimbursement (2024 rate:

For 2024, The Irs Standard Mileage Rates Are:

Effective january 1, 2024, the mileage reimbursement rate changed from 65.5 cents to 67 cents per mile as directed by internal revenue service (irs).

Mileage Reimbursement 2024 Format Images References :

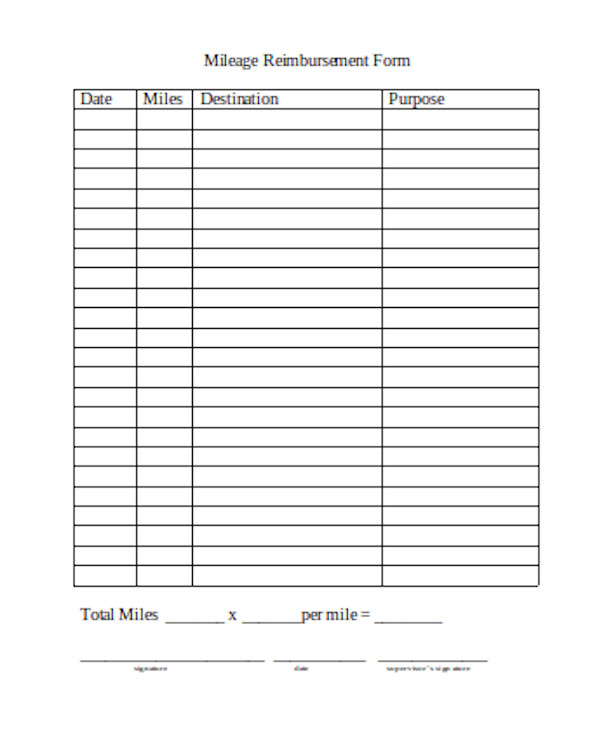

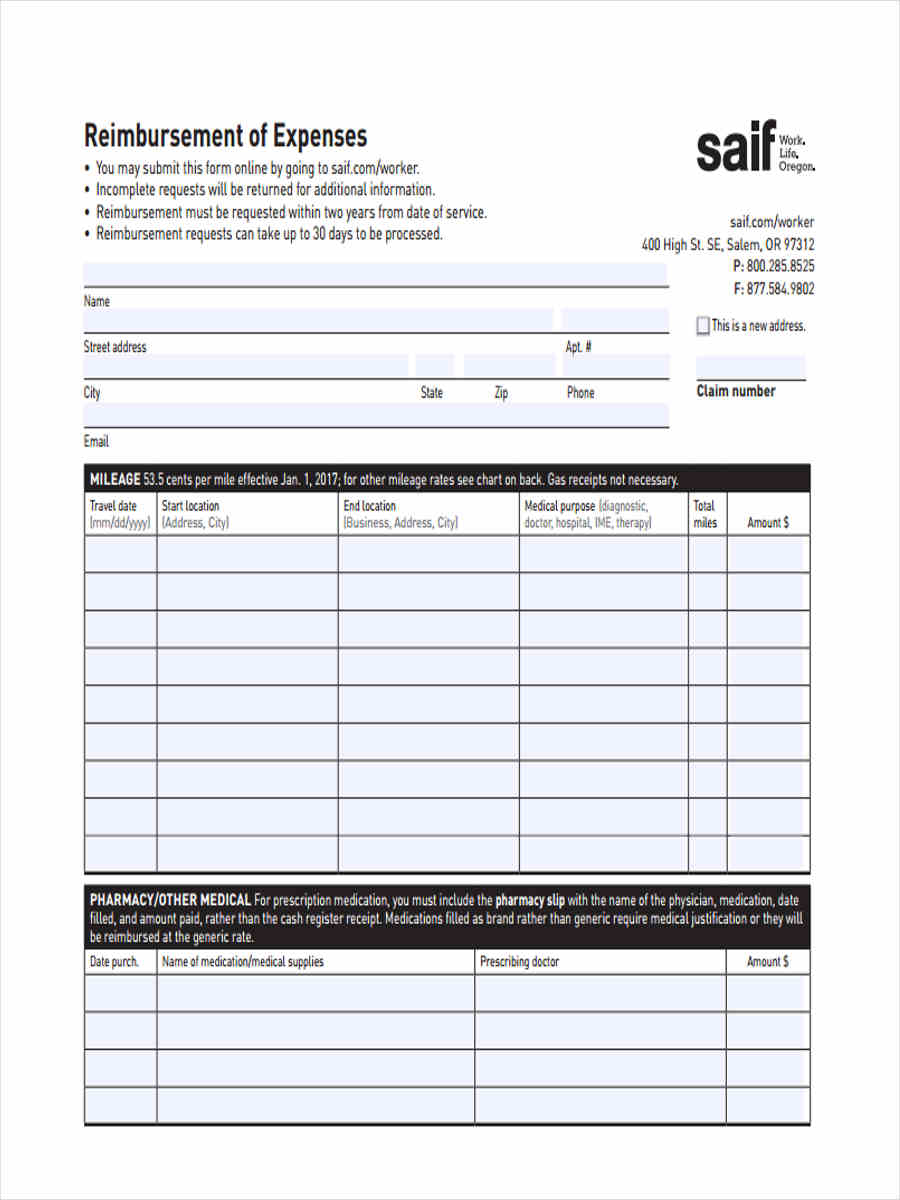

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel, What is the 2024 federal mileage reimbursement rate? For 2024, the irs standard mileage rates are:

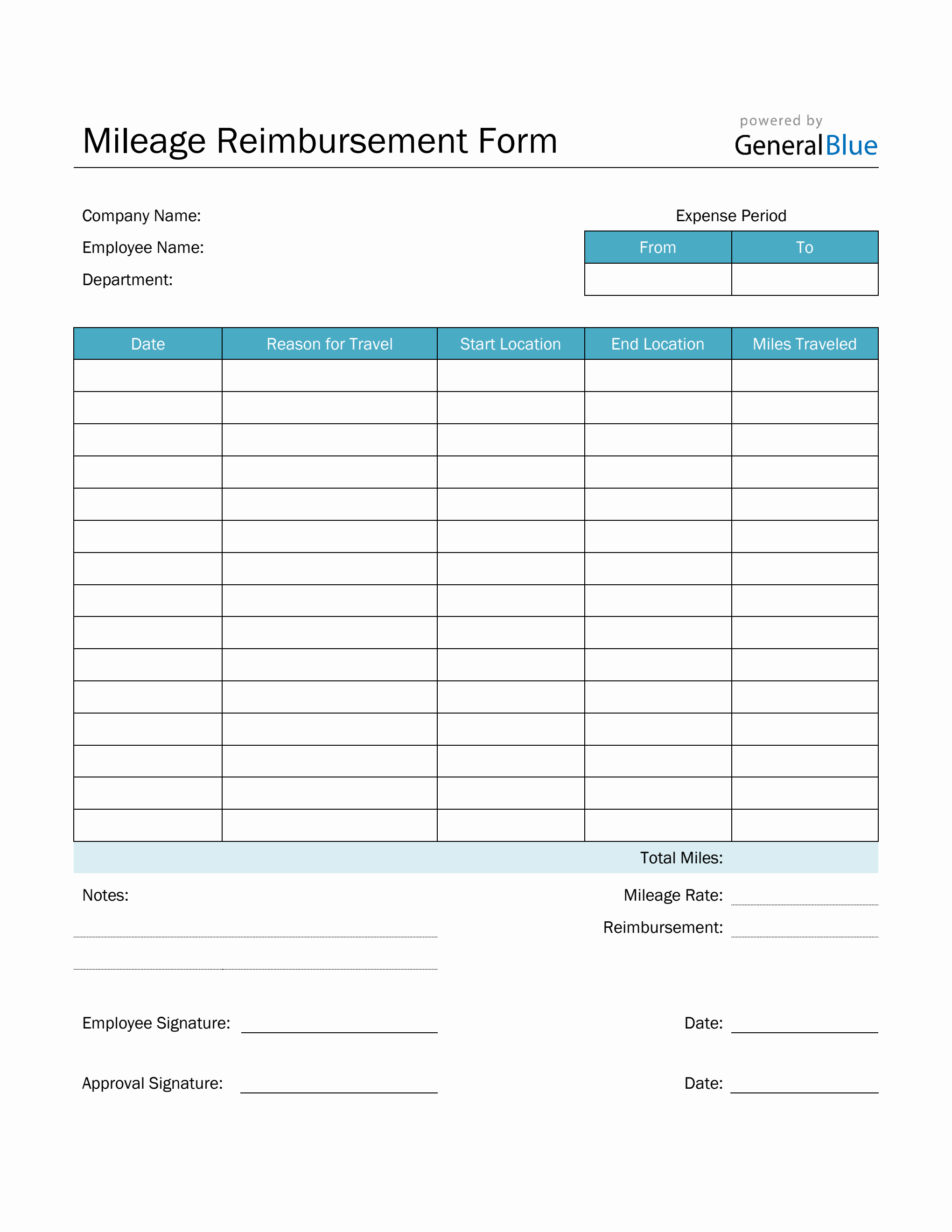

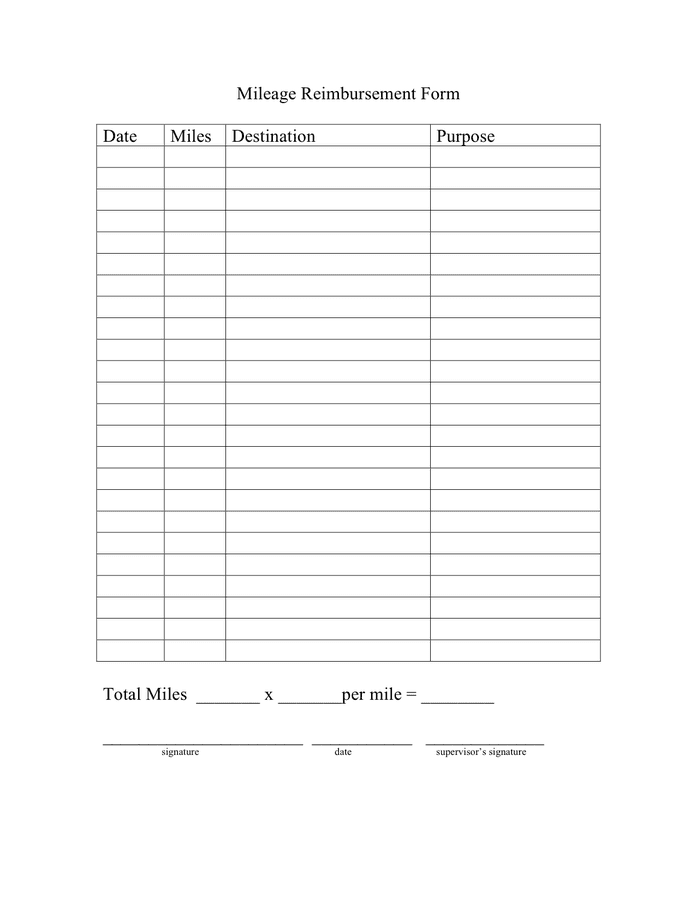

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in PDF (Basic), Learn how to organize, store, and maximize the potential of. The irs sets a standard mileage rate each year to simplify mileage reimbursement.

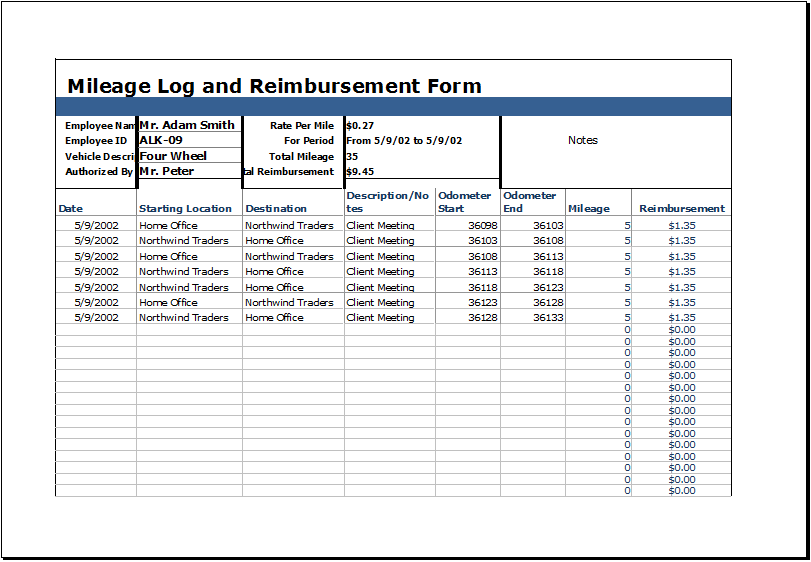

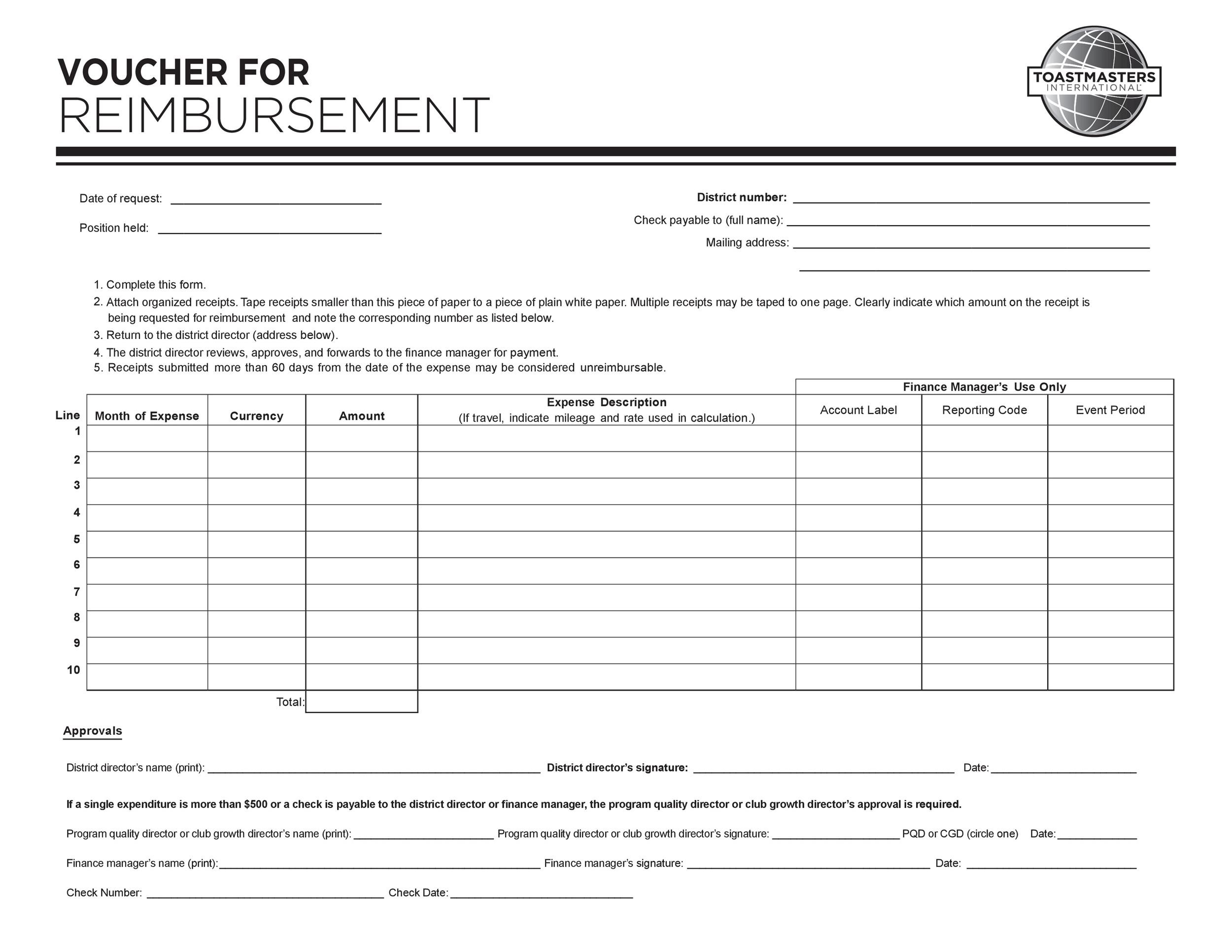

Source: www.dochub.com

Source: www.dochub.com

Mileage form 2024 Fill out & sign online DocHub, You can calculate mileage reimbursement in three simple steps: 21 cents per mile for medical or moving purposes.

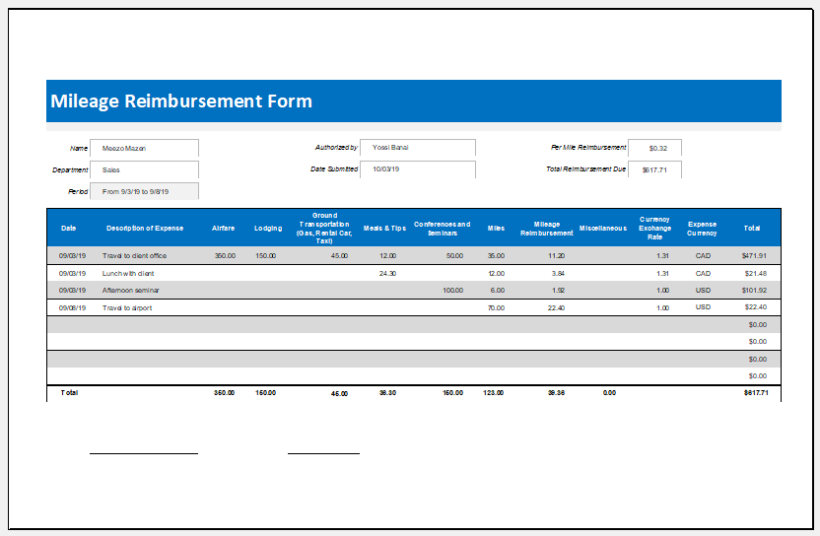

Source: vallyqfelicity.pages.dev

Source: vallyqfelicity.pages.dev

2024 Mileage Reimbursement Rate Ellie Hesther, Calculate for cars and vans, or motorcycle or bicycle rates. 2024 mileage reimbursement rate the irs has announced the update on the standard mileage rate for taxpayers to use the mileage rate and calculate the.

Source: glyndableanora.pages.dev

Source: glyndableanora.pages.dev

Mileage Reimbursement 2024 For Electric Vehicles 2024 Faunie Emmalynn, The irs sets a standard mileage rate each year to simplify mileage reimbursement. 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own.

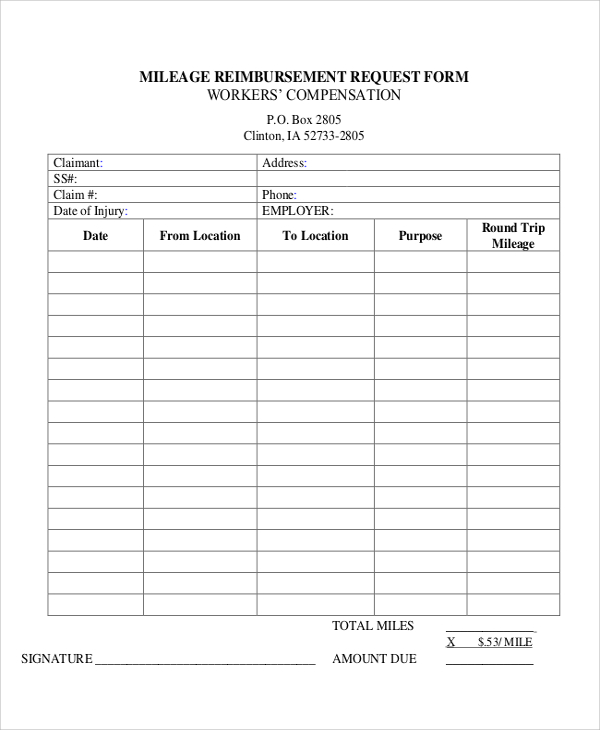

Source: goldiaqpersis.pages.dev

Source: goldiaqpersis.pages.dev

Workers Comp Mileage Reimbursement 2024 Amity Beverie, Determine the applicable mileage rate: The 2023 mileage rate was 65.5 cents per mile driven for business use.

Source: rannaqlinnea.pages.dev

Source: rannaqlinnea.pages.dev

Gas Mileage Allowance 2024 Candi Corissa, What is the federal mileage reimbursement rate for 2024? Alternatively, i can use my own car with irs mileage reimbursement (2024 rate:

Source: magavernice.pages.dev

Source: magavernice.pages.dev

Car Mileage Reimbursement 2024 Giana Babbette, Calculating mileage reimbursement involves a few key steps: Car expenses and use of the.

Source: nanciewguenna.pages.dev

Source: nanciewguenna.pages.dev

Vsp Reimbursement Form 2024 Alyse Bertine, An effective policy is the cornerstone of any mileage reimbursement scheme. Input the number of miles driven for business, charitable, medical, and/or moving purposes.

Source: angelatamera.pages.dev

Source: angelatamera.pages.dev

Mileage Reimbursement 2024 Uk 2024 Elyse Imogene, This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

According To The Irs , The Mileage Rate Is Set Yearly “Based On An Annual Study Of The Fixed And Variable Costs Of Operating An Automobile.” Here Are The Mileage Rates For The Year 2024:

Determine the applicable mileage rate:

The 2023 Mileage Rate Was 65.5 Cents Per Mile Driven For Business Use.

Learn how to organize, store, and maximize the potential of.